“The inherent vice of capitalism is the unequal sharing of blessings; the inherent virtue of socialism is the equal sharing of miseries.”

Winston Churchill

Introduction

Although core to the economic life of all Americans (and many other citizens around the world), capitalism as a system is often misunderstood or conflated with other “free market” notions such as Laissez-faire economics or even libertarianism. This is partly due to political expedience and partly due to the fact that capitalism is a complex subject requiring a reasonable understanding of a number of economic principles – principles that are not normally taught in school outside those who choose to focus on the “dismal science.”

Capitalism grew out of the notion of the “Invisible Hand,” a term coined by Adam Smith in The Theory of Moral Sentiments (1759) and promoted further in The Wealth of Nations (1776). His theories were related to the notion of Laissez-faire (literally “let do” in French) economics — a term already in use in the 18th century – which promoted the idea of private transactions being free from government intervention such as regulations, tariffs, etc. The point of this Invisible Hand is that individual transactions guided by self-interest produce the most desirable societal outcome (versus, for example, a central authority determining what is best for everyone). These concepts are the foundation of neoclassical economics.

We tend to think of Adam Smith as prescient. By most measures, capitalism has brought the greatest increase of wealth to the most citizens of the world compared to any competing economic system, although certainly this wealth and income has been unevenly distributed. Capitalism is based on an ideology of private ownership, the profit incentive, and competitive markets. This efficiency and built-in incentives, in turn, promote innovation and products and services of the highest quality for the lowest cost[1]. Fundamental to capitalism are the notions of:

- Consumers “voting” with their money;

- Competition to drive cost reduction and improve goods and services;

- Individuals working in jobs where they can make the most money for the value they bring; and

- The discipline of self-interest (for companies, workers, and consumers).

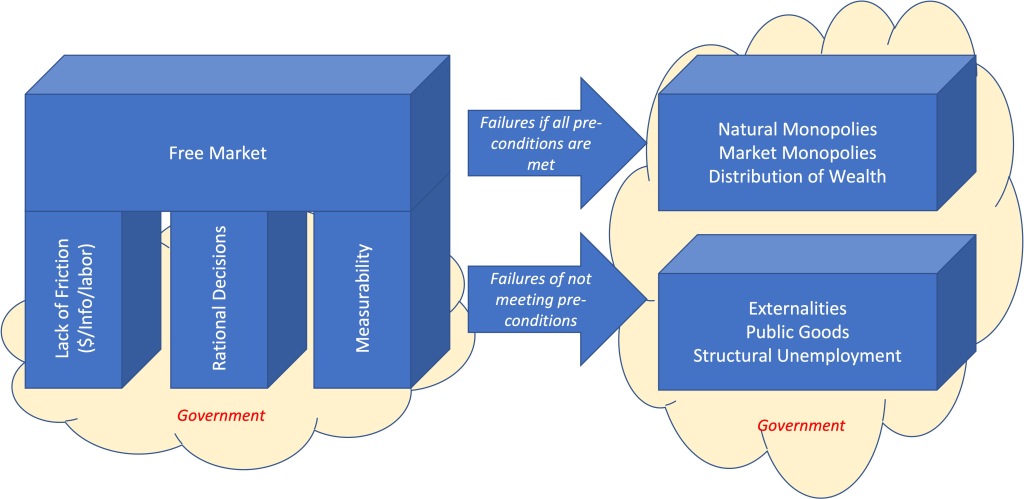

Over the last two centuries, many countries have adopted a quasi-capitalistic system as the core to their economy, and it could certainly be argued that these modern economies (including the U.S.) allocate resources much more efficiently than competing systems such as socialism. No economist denies the power of the Invisible Hand; however, they have debated how powerful it is and where it works and where it doesn’t. This debate is the core to understanding capitalism, which isn’t synonymous with the “free market.” The former includes the latter at its core, but very few economists believe that a Laissez-faire approach can address all of society’s economic (and certainly non-economic) issues. Free market economics is a construct, and like most constructs it works in a conceptual vacuum (or “on paper” as some would say). In reality, there are many pre-conditions and market failures in Laissez-faire economics. Only taken in this entire context can we understand capitalism and what approaches work and don’t work. Both policymakers and citizens need to understand the larger ecosystem of capitalism to support evidence-based economic policy.

Pre-Conditions to Efficient Markets

Capitalism as we know it is based on several assumptions, as this efficient allocation of resources is only possible if every private transaction is based on “perfect information” (an economic concept that consumers and producers are assumed to have complete knowledge of price, utility, and quality of all products and services). We know in practice it’s near impossible to have perfect information about anything, but we generally assume that close approximations will enable decisions good enough to bring out that overall societal and economic efficiency. However, approximating perfect information is often difficult to achieve. We get the closest to that efficient decision-making when (a) there is no “friction” in the system, (b) we make rational decisions, and (c) we can measure both the cost and utility of each good and service.

Economic friction is the hidden (or not-so hidden) costs, time, or other resources required to execute a rational transaction. These can be relatively minor (e.g., the time it takes me to write a check to a vendor and mail it) or it can be significant (e.g., it takes months for me to find the right job). Laissez-faire economics only works perfectly when there is no friction, because the existence of such friction effectively alters the efficient allocation of resources by (i) not allowing markets to quickly adjust to supply and demand forces, (ii) mispricing resources in a non-transparent way, or (iii) by encouraging suboptimal decisions. However, like most issues, we ignore the minor ones and focus on the more significant areas of friction in the system. In general, there are three major areas where there could be significant economic friction – information, capital, and labor.

The ability to make a rational decision is, by definition, based on both buyers’ and sellers’[2] understanding exactly what they are buying and selling. Ergo, information must travel seamlessly and with minimal cost among all parties to a transaction. Most likely in real life, the seller will have more information than the buyer, and this asymmetry of information presents a significant inefficiency in the system (buyers purchasing the wrong items, etc.) and reduces the power of the Invisible Hand. However, the information revolution of the last few decades has certainly done a lot to promote more efficient transactions – think how more efficiently we spend our dining dollars now that we have Yelp! Despite this improved information velocity, an additional obligation to approximate a level playing field between both sides of a transaction may fall to the government – sometimes regulation is required to ensure all economic actors have access to the information needed to make an efficient transaction. This can manifest itself in numerous ways, from nutrition labels to truth in advertising laws to SEC investor disclosures. So much of government intervention is actually focused on making the market more efficient by empowering the Invisible Hand with the frictionless flow of information.[3]

As almost all economic transactions require some form of financial consideration (i.e., money), efficient exchanges can only be made if there is a free flow of capital. This is the area where we are probably closest to a frictionless environment, as we can largely move money around the globe with minimal cost. There are of course significant barriers with capital controls and other restrictions especially as we think of international money exchanges, but this is another area where technology in the form of electronic payments (both institutional and peer-to-peer) definitely promotes a more efficient market by allowing all of us to make relatively low-friction global transactions. It’s also important to note that it normally requires a central entity to manage the money and the money supply to enable this frictionless system.[4]

The third area of potential friction – within the labor market – is the one that by its very nature is nearly impossible to make frictionless. People cannot be redeployed on the most optimal task for their abilities in a short period of time without costs. There are natural barriers to this, including physical location (most people are very tied to their communities, and the barriers to moving – both personal and financial – are incredibly high), training needed, and other “switching costs” of changing jobs. Naturally, a greater prevalence of “telework” reduces this friction somewhat, but there are too many structural issues to ever have a frictionless labor market. This dynamic will naturally result in a permanent market failure of capitalism – structural unemployment (see below).

The second main pre-condition of capitalism is that each of us will always make a rational, self-interested, decision in everything we do. Although we can say that maybe we come close most of the time, this rationality is generally disproven through psychology and economics research.[5] This is an area that perhaps can be improved with better and freer flow of information, but there is some acceptance that humans won’t always act rationally.

It’s important to note that an “irrational” decision is not always due to a buyer just failing to do his/her research, but rather on the fallibility or corruptibility of the seller. Whether it be oil spills, unsafe toys, or financial market manipulation, capitalism does not in and of itself protect the citizenry from unscrupulous, manipulative, or incompetent behavior. Because almost always this behavior is hard to anticipate and hard to uncover until the damage has been done, it’s extremely difficult to have frictionless information upon which to make economic decisions. In some cases, governments regulate certain standards of behavior or production (e.g., food safety regulations) to place on check on capitalism’s potential excesses.

Lastly, the nature of making a rational decision requires that the cost and utility (value to the purchaser) can be measured easily. If we can’t measure the value of something, how do we then make rational decisions? Albeit many things in the economy can indeed be measured, the nature of some goods and services make it difficult. Some activities cost more to measure than the value of the activity itself, and for some endeavors their value is more evident over the long term (e.g., education) and therefore difficult to use as a basis for making an investment years earlier. Also, there are services affecting multiple people where the group cannot come to an agreement on what they are worth (e.g., the value of saving a certain number of lives by putting a guard rail on a winding road). Therefore, you will often find government intervention in areas where it knows the private sector will not be able to accurately measure or assign costs or value, such as externalities and public goods (see below).

Failures Because Pre-Conditions Not Being Met

Most economists will agree that there are a number of areas where the Invisible Hand doesn’t push things very well. The inability to completely satisfy the pre-conditions of capitalism inevitably lead to specific market failures. Many transactions affect more than just the finite number of actors involved in such transaction, and that combined with the difficulty in measuring such effects – both in the short-term and long-term – lead to economic phenomena called externalities and public goods. In addition, the friction in the labor market is a direct cause of something called structural unemployment.

An externality is an effect (positive or negative) on an individual or other economic entity not party to a specific transaction. Just like the pre-conditions to capitalism, there are minor externalities and major ones, and policymakers will of course tend to focus on the latter. But make no mistake – externalities are everywhere. We just tend to ignore many of them, such as my neighbor’s failure to upkeep his house negatively affecting my property value. Of course, even with these relatively minor externalities, local governments (or homeowners’ associations) may put in laws and regulations specifically to minimize these types of externalities. Land use management by local governments is, in part, an attempt to manage externalities. The more classic example of a significant negative externality is pollution – there are negative health effects to many residents near a power plant even if many of those residents are not involved with, or customers of, the company owning such plant. This is why a government’s role is often to manage these negative externalities or even on occasion try to put a price on such effect. Economists call this “internalizing” an externality, having the costs and benefits burden primarily the parties who choose to incur them. For example, some argue that a carbon tax would be an internalization of an externality and would more accurately (and therefore more efficiently) price carbon-based products. There are of course positive externalities, but we often tend to ignore these. An example could be the increasing value of a home based on a positive reputation of schools in that area.[6]In any case, any transaction with non-internalized externalities inherently creates an inefficiency in the market by either underpricing or overpricing a good or service relative to the one which would provide the most efficient allocation of the resource.

A public good is a needed product, service, or activity where the value is so dispersed among the citizenry that it is impossible or cost-prohibitive to measure the value provided to each person and/or extremely difficult to collect payment for such value. Also, a public good tends to be non-rivalrous, meaning its consumption by one individual does not reduce its availability to others.[7] Often the larger the scale of the service, the harder it is to measure the benefit (or collect payment) from this large population. The classic example of a non-rivalrous public good is national defense – although citizens may disagree on its utility (hence the measurement problem as described above), it exists to serve all citizens, and it would be a foolish exercise to try to determine the specific utility that any individual receives from it. Other areas, such as roads and other forms of public infrastructure such as parks, streetlamps, and sidewalks, are also often classified as public goods, even if the value of having these does not likely benefit everyone equally. Public education is often thought of, in part, as a public good as well because the value of a child being educated extends beyond just that child. Even though we know it has value to the rest of society, it is difficult to measure and hence “price.” Therefore, public goods tend to be paid for by a public entity collecting taxes and fees rather than through a private-sector pricing model. However, there are a number of services which are considered private good/public good hybrids (e.g., toll roads), and governments certainly charge fees as well where they can approximate a private benefit even if related to a public good. Both education and health care, for example, have some characteristics of a private good but also many characteristics of a public good. In addition to the utility I receive, there are benefits to the remainder of society if I am both healthy and well-educated (by higher societal productivity as well as perhaps reduced costs in other public goods, such as crime prevention).[8]

Structural unemployment is a significant and widespread mismatch between the skills of potential workers and those needed in the economy. This often happens when a specific industry is disrupted and the existing workers in that industry are not able to seamlessly transition to work in other industries.[9] Structural unemployment is, in effect, a byproduct of the inherent friction in the labor market, because if there were no friction, we wouldn’t care if technology put certain industries out of business and/or workers out of a job because everyone would be immediately redeployed to other ventures. It’s also relevant to note that the economic friction from structural and other forms of unemployment is not uniform across sub-populations; for example, it is often more difficult for an older worker to find a new job if his/her skills no longer match the needs of the labor market. This is why government may intervene to support workers and communities affected by the normal march of capitalism and could include services such as job creation programs, training programs, and unemployment insurance.

Failures Even if These Pre-Conditions Are Met

Even if it were the case that all of the pre-conditions of capitalism are met (even though we know they aren’t), there are still structural failures that a free-market system cannot handle (and hence must be managed or mitigated by a government entity). In addition, the nature of operating businesses creates situations where it is impossible to have efficient competition. Ignoring the multitude of non-economic societal effects of capitalism (long debated by politicians, philosophers, political scientists, and many others), we will focus on three major free market failures of the Invisible Hand – (a) natural monopolies, (b) market monopolies, and (c) distribution of wealth.

If there is a single supplier of a good or service in any market, it is considered a monopoly. Monopolies, however, are inherently inconsistent with the stated goal of a free market to most efficiently allocate society’s resources. The lack of competition allows the monopoly to overprice and under produce goods and services, creating what economists call a “dead weight loss” of economic efficiency.[10] So, the principles of free-market capitalism – including the optimal allocation of resources (and hence maximum overall wealth growth) – would then demand minimizing the existence or powers of monopolies.

Monopolies can happen for several reasons. A “Natural” Monopoly is a situation where a market is actually most efficiently served by a single provider. This tends to happen in industries where there are very high capital costs and the economies of scale prevent effective competition. Often a natural monopoly is one where the benefit of competition among providers is dwarfed by the costs of having duplicate infrastructure or systems to provide such services. The utility industry – particularly the delivery of electricity and natural gas – is a classic example of this phenomenon. Although having two or more providers of this service would create competitive downward pressure in prices, the added overall costs of each company having its own duplicative infrastructure (e.g., wires and pipelines, including to each home) would wind up increasing the cost for all customers. Therefore, most natural monopolies are allowed to exist but in turn are regulated by city, county, or state governments to ensure these providers don’t extract monopoly profits like an unregulated monopoly would (see below). As technology evolves over time, some industries get disrupted, changing the natural monopoly economics. For example, many cities have looked at alternative, “green” energy providers that could put pricing pressure on legacy electrical companies. However, it would be inefficient to build a second energy grid, so one could imagine this industry developing over time where the “grid” remains a natural monopoly regulated by the government but allows for multiple competitive energy generators to connect to that grid. There are certainly other industries that are natural monopolies in whole or in part, including areas such as health care and education. Natural Monopolies are another area where the intervention of a regulating entity is required to achieve optimal efficiency. In some countries, the government itself is the provider of these natural monopoly services, whereas the U.S. tends to regulate a single private provider in most of these cases.

Some monopolies are not “natural” but result from the normal – and often inevitable – machination of capitalism, barring any check on the activities of these companies from a regulating entity. This may happen due to factors that prevent perfect competition, high switching costs for consumers, or markets moving faster than rivals can keep up (another form of friction in the system). These monopolies often form by acquisitions and mergers, but they can also happen by a company’s great success allowing it to take over an industry. Why should we care if monopolies develop in the normal course of capitalism? Ironically, these monopolies spawned by the free market then become inefficient allocators of resources. This is why we see governments often putting restrictions on monopolies or enacting antitrust regulations to prevent them happening in the first place.

The Invisible Hand is not just invisible, but also blind to anything except economic power. It makes no judgments of “fairness” and isn’t designed to promote everyone having similar (or even a minimal amount of) income or wealth. Even though average wealth is greater than in a non-capitalistic economic system, Laissez-faire economics tends to promote unequal distribution of wealth and perpetuates such inequalities. So, we have to recognize that economics has its limitations – most societies would argue that there are also moral considerations in resource allocations, such as support for the elderly or those with other limitations that prevent them from fully taking advantage of the opportunities of capitalism. Of course, almost one-quarter of the U.S. population is children, who generally don’t have the position to fully participate in a free-market economy. It’s also important to recognize that even in a completely frictionless system, capitalism isn’t agnostic to one’s starting point – there will always be inherent advantages to succeed in the free market when one starts from a higher socio-economic level or has other societal advantages. This is why most capitalist counties still provide some sort of “safety net” (the size and scope of which varies greatly) and policies to mitigate the inherent “starting point advantage” (e.g., progressive taxation, services for under-resourced communities, etc.). But at the same time, it’s worth noting that economic power tends to buy other advantages, including political power, which can in turn mold the economic system further in favor of those already advantaged.

Role of Government

None of this analysis is to suggest that government intervention is a perfect solution to deal with any of the failings of capitalism. However, despite the oft-cited notion that government is the enemy to capitalism, governments have a key role to play in actually promoting capitalism’s very promise. And that role is distinct from the role of businesses due to government’s unique burden and ability to deal with externalities, public goods, friction, and other failures in the capitalistic system. Capitalism and government have a co-dependent relationship – they truly need each other!

In undertaking these capitalism-promoting efforts, government’s efforts may introduce new inefficiencies in the system, but hopefully they create value greater than its costs. Of course, governments may put up barriers to capitalism for all kinds of reasons, not necessarily economic. Whatever the reason, the imposition of taxes, quotas, or other restrictions often create another friction in the system, potentially “misprice” goods and services (intentionally or unintentionally), or otherwise introduce inefficiencies or deadweight losses. However, smart government regulation can indeed make the free market more efficient by pricing in externalities or public goods, minimizing the inefficiencies of monopolies, reducing friction in the system, and dealing with the other failures of unfettered free markets. And above all, no one doubts that a strong economic system requires a fair and robust justice system to enforce laws and ensure all economic actors are behaving transparently.

Conclusion

Every country on earth debates the role of the private sector — and capitalistic or near-capitalistic systems of deploying resources — versus the role of the public sector, including both national and local governments. Every country debates the relative merits of economic growth, economic stability, economic equality, short-term vs. long-term prosperity, and a myriad of moral issues related to making such choices. Although hardly a perfect system, the capitalistic system in the United States has been the engine for immense growth in overall wealth and productivity, albeit not evenly distributed throughout the population.

However, it would be more than naïve to assume any system is perfect. Just because its general principles seemingly work most of the time, that doesn’t mean they always do. Unfortunately, many people (including elected officials) have a very limited understanding of economics and blindly apply the principles of Laissez-faire upon every situation without understanding the very complex and nuanced ecosystem.[11] If anything, left to its own devices, free-market orthodoxy (because it doesn’t take into account the issues discussed above) by design would wreak havoc on the society it is purportedly serving. We will explore some specific examples throughout this book.

Instead, smart government policy could actually optimize the promise of capitalism, and lawmakers should map their specific policies and programs to capitalism’s pre-conditions, exceptions, and side effects that need to be managed. Only with this approach can citizens better understand the reasons for certain policies, debate the utility of such solutions, and ultimately come up with the most effective allocation of any resource, public or private.

[1] Of course, most people would argue that very few products are really of the “highest quality” – this is because even relatively efficient markets aren’t perfect markets and are subject to the “frictions” and other problems outlined later in this paper.

[2] Note that I use the terms “buyer” and “seller” broadly. Transactions also include many other types of dealings, including financial investments, where an investor is in the same position as a buyer of a good or service, and a fund-raising company is analogous to the seller.

[3] It’s hardly coincidental that so many companies resist regulation that gives their customers more transparent information as this would reduce the seller’s built-in advantage of asymmetric knowledge.

[4] Monetary policy is an entirely different subject altogether which is outside the scope of this paper.

[5] There is a wealth of psychology research outlining where and when humans make decisions not in their own interest.

[6] There is another economic concept called the “free rider problem” which is effectively an entity exploiting a positive externality. Depending on its severity and perceived fairness, this is often dealt with via public policy as well.

[7] An “public good” as defined by many economists has a stricter definition, but I am using it more broadly for the purpose of this analysis.

[8] Buyers can “opt out” of public systems in certain areas, including private education. But the use of a private system doesn’t mean there still isn’t a public good effect of that transaction (it just normally isn’t priced into it).

[9] There are other categories of unemployment such as frictional unemployment (being between jobs) and cyclical unemployment (caused by a general economic slump), and these have similar implications for the both the efficiencies of the market and needed public policy.

[10] There are entire sectors of economic study devoted to understanding and measuring the effects of monopolies as well as analogous situations such as monopsonies and many other issues related to competition and pricing.

[11] Many other areas to explore and not covered here include monetary policy, fiscal policy, international trade, tax policy, moral hazards of insurance, the relationship between federal and state policy, and many other microeconomic and macroeconomic issues.